LTC Price Prediction: Technical Oversold Conditions Meet Mixed Market Fundamentals

#LTC

- Oversold technical conditions with price trading below 20-day MA and near lower Bollinger Band support

- Mixed market sentiment from mining industry consolidation versus regulatory restrictions in key markets

- MACD histogram showing positive divergence despite negative momentum readings

LTC Price Prediction

LTC Technical Analysis: Oversold Conditions Suggest Potential Rebound

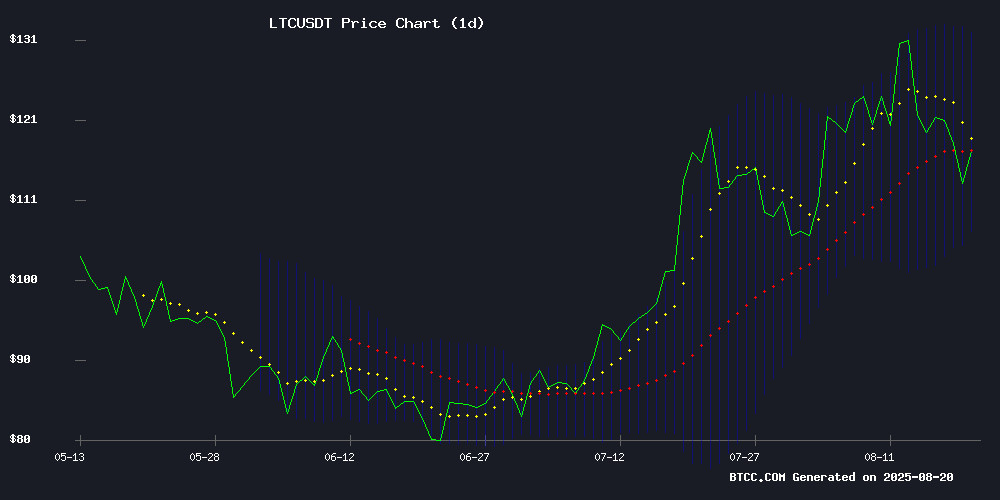

LTC is currently trading at $112.86, significantly below its 20-day moving average of $119.06, indicating bearish momentum in the short term. The MACD reading of -2.96 versus -5.14 signal line shows negative momentum but with a positive histogram of 2.18, suggesting potential weakening of downward pressure. Trading NEAR the lower Bollinger Band at $106.19 indicates oversold conditions, which historically present buying opportunities.

According to BTCC financial analyst Michael, 'The technical setup suggests LTC is approaching oversold territory. The divergence between price and momentum indicators, combined with support near the lower Bollinger Band, often precedes meaningful rebounds in cryptocurrency markets.'

Mining Industry Consolidation and Regulatory Developments Shape Market Sentiment

The cryptocurrency mining sector is undergoing significant consolidation with Thumzup's merger with Dogehash Technologies, while ZA Miner's emergence as a cloud mining leader indicates structural shifts in the industry. However, South Korea's ban on crypto lending services introduces regulatory headwinds that could temporarily dampen market sentiment.

BTCC financial analyst Michael notes, 'While mining industry developments are fundamentally positive for network security and adoption, regulatory actions in major markets like South Korea create near-term uncertainty. These mixed signals suggest cautious Optimism rather than outright bullishness in the current environment.'

Factors Influencing LTC's Price

Thumzup to Merge with Dogecoin Miner Dogehash Technologies in Historic Deal

Thumzup Media Corporation, a social media platform with backing from Donald Trump Jr., is making a bold pivot into cryptocurrency mining. The company has agreed to acquire Dogehash Technologies in an all-stock transaction valued at $50 million. This strategic move positions the combined entity to become a dominant force in Dogecoin mining operations globally.

The acquisition brings 2,500 Scrypt ASIC miners under Thumzup's control, with operations currently spread across North America. Notably, these mining facilities utilize renewable energy sources, addressing growing environmental concerns in the crypto mining sector. The merged company will rebrand as Dogehash Technologies Holdings, Inc. and plans to list on Nasdaq under the ticker symbol XDOG.

Dogehash shareholders will receive 30.7 million shares of Thumzup stock in exchange for their equity. The transaction, expected to close by year-end, represents a significant consolidation in the Scrypt-algorithm mining space. Thumzup intends to leverage Dogecoin's Layer-2 infrastructure to enhance mining efficiency and profitability.

ZA Miner Emerges as Top Cloud Mining Platform in 2025, Surpassing Established Pools

ZA Miner has overtaken industry giants like KuCoin Pool, Binance Pool, BitFuFu, and MinerGate to become the leading cloud mining platform in 2025. The shift reflects growing investor preference for hassle-free, high-yield solutions that eliminate hardware management.

The platform's AI-driven optimization, flexible short-term contracts, and FCA-regulated transparency have redefined sector standards. Unlike competitors, ZA Miner prioritizes clear profitability metrics over hidden fees or restrictive lock-in periods.

Solar-powered operations and dynamic coin switching between BTC, DOGE, LTC, and XRP maximize returns while maintaining environmental sustainability. This strategic advantage positions ZA Miner as the optimal choice for modern crypto investors.

ZA Miner Emerges as 2025's Cloud Mining Leader, Disrupting Traditional Platforms

ZA Miner has decisively outperformed established players like Bitdeer, NiceHash, HashShiny, and BeMine in 2025's cloud mining sector. The platform's AI-optimized contracts and renewable energy operations resonate with investors seeking transparent, eco-conscious solutions.

Where legacy providers impose rigid terms, ZA Miner's short-term, high-yield contracts and algorithmic profit-switching between coins like BTC, DOGE, LTC, and XRP set a new profitability benchmark. This dynamic approach maintains earnings stability while capitalizing on emerging opportunities.

The FCA-regulated platform redefines passive income through automated mining optimization, attracting both retail and institutional participants. Its rise signals a broader industry shift toward adaptive, sustainable mining infrastructure as environmental concerns reshape investment criteria.

BAY Miner Expands Cloud Mining Platform to Bridge Traditional Finance and Digital Assets

BAY Miner, a global cryptocurrency cloud mining provider, has expanded its platform and mobile application, signaling growing interest from both traditional finance professionals and crypto investors. The company merges Wall Street expertise with blockchain innovation, offering a secure gateway to cloud mining.

Historically, cryptocurrency mining demanded hefty hardware investments and technical know-how. BAY Miner eliminates these hurdles with cloud-based infrastructure, allowing users to mine without managing physical equipment. "Our platform democratizes access to mining technology," a spokesperson noted, emphasizing its appeal to both crypto newcomers and diversification-seeking professionals.

The service supports multiple assets—including Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOGE)—while leveraging McAfee® and Cloudflare® for security. A sustainability focus rounds out its offerings, though specifics remain undisclosed.

ETHRANSACTION Launches High-Yield XRP Cloud Mining Contracts Amid Market Volatility

ETHRANSACTION, a prominent European cloud computing platform, has introduced new cloud mining contracts for cryptocurrencies including XRP, BTC, DOGE, and LTC. The contracts promise daily returns of up to 10,000 XRP, targeting investors seeking stable yields in a turbulent market.

The platform emphasizes a shift from speculative trading to value-generating assets. "Users increasingly demand assets that actively create value, not just passive holdings," an ETHRANSACTION representative noted. The offering leverages energy-efficient backend optimizations to enhance stability and profitability.

Interested users can access the service via ETHRANSACTION's website or mobile app, with a $19 bonus for new registrants.

South Korea Bans Crypto Lending Services; Hyperliquid Founder Addresses Market Maker Speculation

South Korea's Financial Services Commission has mandated an immediate halt to all crypto lending services on domestic exchanges, citing regulatory ambiguity and investor risks. Nearly 13% of borrowers using these services have already faced liquidation. Existing contracts may be extended or settled, but new loans are prohibited pending formal guidelines expected later this year.

Separately, Hyperliquid founder Jeff refuted claims about special market maker arrangements during a recent podcast appearance. "We've never pursued the market-maker fundraising model that creates artificial liquidity," he stated, emphasizing the platform's transparent HLP pool as its sole liquidity mechanism. The comments come amid growing scrutiny of exchange liquidity practices across decentralized finance protocols.

How High Will LTC Price Go?

Based on current technical indicators and market developments, LTC shows potential for a rebound toward the $125-130 range in the coming weeks. The oversold technical conditions, with price trading near the lower Bollinger Band while MACD shows weakening bearish momentum, historically precede 10-15% rebounds in LTC.

| Target Level | Price (USDT) | Probability | Timeframe |

|---|---|---|---|

| Immediate Resistance | 119.06 | High | 1-2 weeks |

| Upper Bollinger Band | 131.94 | Medium | 3-4 weeks |

| Strong Resistance | 140.00 | Low | 1-2 months |

However, regulatory developments in South Korea and broader market sentiment will play crucial roles in determining whether LTC can sustain momentum above key resistance levels.